The private capital investment industry is growing rapidly, but talent management and acquisition challenges persist.

As a continuation of our series on asset management, this report will examine:

- Key factors impacting the growth of Canadian private capital.

- Talent management challenges and opportunities for organizations in this evolving environment

In Canada’s expanding private capital industry, organizations must implement forward-thinking strategies to attract and retain leaders capable of driving growth and innovation.

Massey Henry’s recent executive survey underscores the urgent need to address key talent challenges in the sector, including retention, increased competition, diversity, and skill gaps driven by technological advancements in AI and machine learning. Successfully navigating these issues will be critical for the industry’s long-term growth and success.

Our latest report examines talent management challenges and opportunities in the growing Canadian private capital sector.

Introduction

The Canadian private capital investment industry is critical for providing financial and management expertise to support various businesses, from early-stage startups to mature companies.

Recent survey data compiled by the Canadian Venture Capital and Private Equity Association (CVCA) and PwC indicate that companies backed by the Canadian private equity industry employ 195,000 people and generate annual revenues of $55 billion.

However, this trend towards private capital also presents challenges to the economy. The success of these investment opportunities largely depends on the talent they can attract and retain.

Despite the rapid growth of this sector, talent acquisition and management challenges persist. Talent limitations ultimately restrict growth potential and organizational effectiveness.

Key Factors

There are several factors impacting the growth of Canadian private capital.

The increased use of private capital funding in Canada can be attributed to the following:

1) Fintech Disruption

The rise of financial technology (fintech) companies has disrupted the traditional financial services landscape, creating opportunities for innovative solutions. This has attracted private capital investors who recognize the potential for high returns on investment in this rapidly evolving sector.

2) Growth Potential

With a large and diverse market, Canada’s financial services industry offers considerable growth potential. Private capital investors are drawn to opportunities in digital banking, payment solutions, lending platforms, and wealth management, which can offer substantial returns and market share.

3) Regulatory Environment

Canada has adopted a supportive regulatory environment that encourages investment and innovation in the financial sector. Regulatory frameworks, such as open banking initiatives, have facilitated collaboration between traditional financial institutions and fintech startups, enabling them to access private capital funding.

4) Access to Global Markets

Canada’s proximity and economic integration with the United States, one of the world’s largest financial markets, provide Canadian financial service providers with significant expansion opportunities. Private capital funding allows Canadian companies to scale their operations and penetrate global markets more effectively.

5) Technological Advancements

Technological advancements, such as cloud computing, artificial intelligence (AI), and big data analytics, have transformed the financial services industry. Private capital investors recognize the potential of these technologies to enhance operational efficiency, improve customer experiences, and drive innovation, leading to increased funding for technology-enabled financial service providers.

6) Supportive Government Initiatives

The Canadian government has implemented numerous programs and initiatives to support innovation and entrepreneurship through organizations such as the Business Development Bank of Canada (BDC). These funding arrangements, tax incentives, and research grants have incentivized private capital investment in Canadian financial service providers and fintech startups.

7) Demand for Alternative Financing

In the current climate, traditional financing options like bank loans are not always the most suitable or accessible choice for all businesses. Private capital funding provides an alternative source of financing, particularly for high-growth startups and companies looking to scale rapidly.

These drivers, including favourable economic conditions, a supportive ecosystem, and evolving consumer demands, have contributed to intensified use of private capital funding in Canada’s financial services sector.

Besides being a source of early-stage financing, private capital firms have acquired many potential IPO candidates by offering high valuations and more control to founders and significant stakeholders, often presenting a more attractive option than going public. Alternative funding sources have fueled the growth of small businesses in Canada and driven profound systemic change in the country’s capital markets.

Several factors have accelerated this trend, including the increased complexity and costs associated with regulatory filings, ongoing disclosure requirements, and the control premium provided to founders and significant shareholders in the private investment environment.

The TSX and TSXV have experienced a combined listing decline of over 1000 issuers over the past ten years, representing a 40% drop in active listings.

The data suggests that the decline in public offerings has led to a substantial increase in the utilization of alternative investment sources, such as angel investors, venture capital, and private equity. These changes are dynamic and, in many cases, mirror prevailing global trends. the increased complexity and costs associated with regulatory filings, ongoing disclosure requirements, and the control premium provided to founders and significant shareholders in the private investment environment.

This profound shift, coupled with rapid technology adoption, has created unique challenges in talent acquisition and management for financial service participants.

Talent Implications

Several factors influence the future talent equation for Canada’s financial services industry and market participants that require funding and financial expertise.

There are consequential implications for talent identification, selection, and career development. Talent management programs for leadership teams, functional managers, and employees must adapt to the evolving commercial landscape of Canada’s business sector and the increasing impact of the service economy revolution.

Broad-based technology adoption and sustainability, as well as climate change concerns, will further propel the realignment of Canada’s economic activity.

Survey Results

As the influence of private capital continues to grow in Canada, we asked select C-suite executives and Board Directors across various functions – including HR, Risk, and Chief Executives – within the financial services sector about the talent implications created by the growth of the private sector in Canada.

Key Findings

As private capital continues to expand, the success of these ventures hinges on the quality of leadership talent organizations can secure.

With a significant majority of industry executives acknowledging its impact on talent acquisition, we found that this heightened awareness has led nearly half of organizations we surveyed to adjust their strategies to attract and retain top talent – a trend we expect to continue in line with the sectors growth.

How can organizations in the financial services sector further innovate their talent acquisition and management strategies to stay competitive in a rapidly evolving landscape?

Survey Results

While we have provided a detailed visual outlining the responses, below were some of the key highlights:

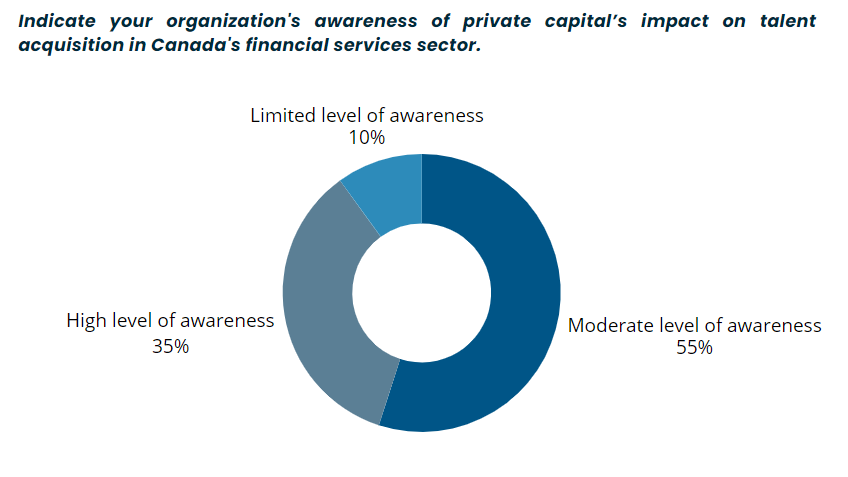

- 90% of our respondents said that their organization has a high or moderate level of organizational awareness regarding private capital’s impact on talent acquisition in Canada’s financial services sector.

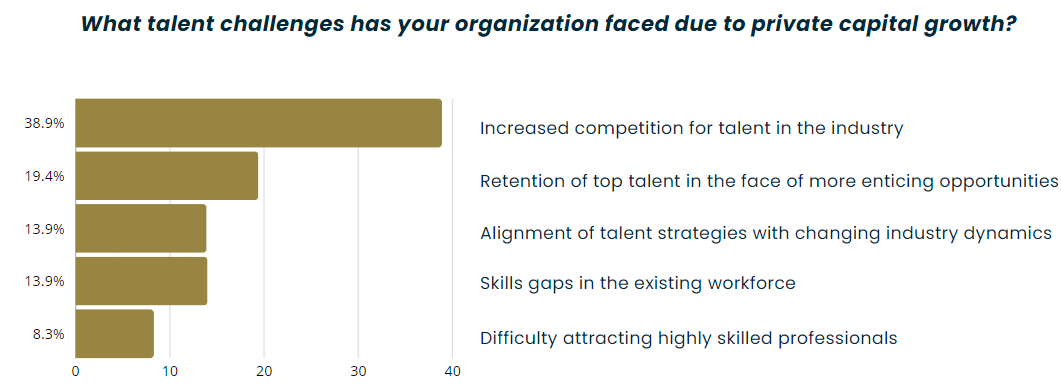

- Nearly 40% of executives surveyed listed increased competition for talent in the industry as a prevalent issue, noting it as one of the key challenges facing their organization due to private capital growth.

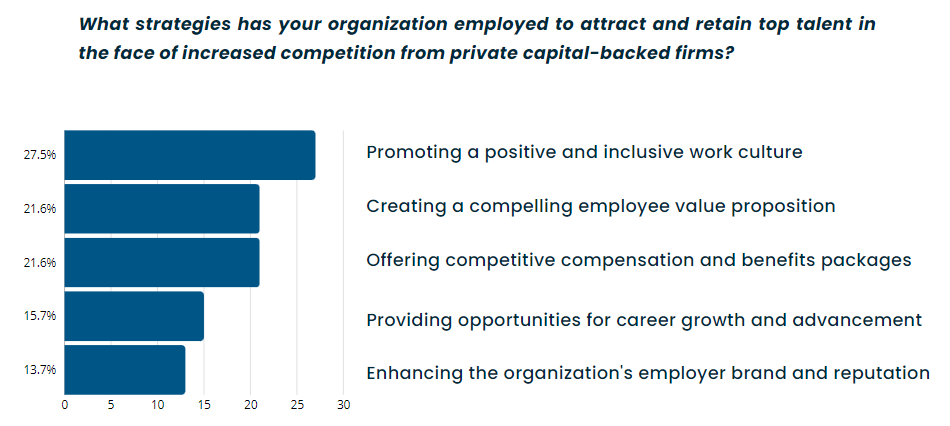

- Almost half (45%) of respondents indicated their organizations have adjusted talent acquisition and management strategies in response to private capital growth. This includes changes relating to:

- Increasing promotion of a positive and inclusive work culture

- Creating a more compelling employee value proposition

- Competitive compensation packages to align with the market

Broadly, the most prevalent changes that leaders cited due to the impact of private capital is a shift in focus towards technological skills and innovation capabilities, as well as an increased demand for professionals with specialized financial expertise. These responses clearly reflect a trending shift regarding talent acquisition and management strategies that aim to ensure employee attraction and retention in an increasingly competitive landscape.

Talent Implications

There are several urgent talent management challenges facing the private capital investment industry, many of which were reflected in our survey responses. These include:

Talent Retention

Retaining top talent is crucial for private capital investment firms, but the industry’s demanding work hours and high-pressure environment often lead to burnout and turnover. Talented professionals frequently seek new opportunities to diversify their skills or explore different sectors.

Firms must implement retention strategies like work-life balance initiatives, competitive compensation, and career development programs.

Equity, Diversity & Inclusion

Industry reports indicate that women and visible minorities are underrepresented in investment firms, leading to less diverse perspectives in decision-making, lower investment performance, and missed opportunities.

Increasing diversity requires firms to implement inclusive recruitment practices, mentorship programs, and foster a culture of inclusion.

Limited Talent Pool

Finding highly skilled professionals with expertise in investment analysis, due diligence, portfolio management, and deal sourcing poses an ongoing challenge. The industry demands individuals with deep financial knowledge, analytical skills, and industry-specific expertise. However, such professionals are in high demand and are often sought after by other sectors, such as investment banking or consulting.

Skills Gaps & New Technological Advancements

The industry is experiencing accelerated technological advancements, including artificial intelligence and machine learning, requiring investment professionals to develop new skill sets.

Bridging the skills gap and equipping investment professionals to leverage new technologies are crucial challenges.

Competition for Talent

Established investment firms and major private equity funds typically have the resources to attract and retain top talent, placing smaller firms and emerging players at a disadvantage. This concentration of talent can make it difficult for new entrants to gain traction or compete on an equal footing, thereby limiting diversity of thought and innovation within the industry.

Looking Ahead

The private capital investment industry faces several talent challenges, including:

- a limited talent pool

- fierce competition for talent

- talent retention

- the need to adapt to emerging technologies

Addressing these challenges is essential for the industry’s long-term growth and success. Investment firms must adopt strategies that attract and retain top talent, foster diversity and inclusion, and invest in continuous learning and development.

By doing so, the industry can enhance its effectiveness, achieve better investment outcomes, and drive innovation in the businesses it supports.

À propos de Massey Henry

Executive Search, Coaching, Assessment, and Advisory Services

Michael Henry

Managing Partner, Massey Henry

John Sanders

Senior Partner, Board & CEO Services

Charlotte Berry

Partner

Alex Bunyan

Partner & Head, Leadership Practice