What is shaping executive decision-making in 2025?

Massey Henry surveyed senior leaders across financial services to uncover key priorities, strategies, and the talent trends defining the year ahead.

As Massey Henry’s recent executive survey highlights, technology-enabled transformation, geopolitical uncertainty, and increased competition for talent will shape talent decisions in the year ahead.

As a corporate director and HR leader — and having partnered with Massey Henry on a board mandate — I believe that strong leadership will be crucial to fostering resilience and ensuring financial institutions can innovate while maintaining trust and stability.

What’s driving executive talent decisions within financial services in 2025? See the results from our latest industry survey.

Key Survey Findings

High-demand Leadership Skills in an Evolving Industry

People leadership and team development remain critical as organizations navigate workforce dynamics, including hybrid and remote work environments. Leaders must foster collaboration across diverse teams while integrating specialized skills in advanced technologies like AI, blockchain, and quantum computing. Additionally, technological fluency and risk management expertise are essential for addressing cybersecurity threats, regulatory complexity, and emerging geopolitical challenges.

Escalating Competition for Talent

Competition for skilled executives is intensifying, driven by the demand for niche expertise in areas like digital transformation, fintech, compliance, and ESG. To stay competitive, organizations must balance internal talent development — through coaching, mentoring, and skill-building — with external expertise in talent acquisition, leadership assessment, and succession planning. Aligning these specialized skills with broader business objectives will be essential to maintain strategic momentum.

Balancing Innovation with Agility

Emerging technologies and geopolitical uncertainty are transforming the financial services landscape. While these advancements unlock new efficiencies, they also demand strong leadership to balance innovation with resilience in the face of uncertainty. Organizations must adopt agile strategies to address evolving talent needs, drive innovation, and sustain growth.

Actionable Strategies for Leadership in 2025

1) Develop Leadership Pipelines

2) Leverage External Expertise

3) Align Skills with Strategic Goals

4) Adopt Agile Strategies

5) Enhance Risk Management Capabilities

The Talent Imperative: Attracting and Retaining Top Leaders

Competition for skilled executives and professionals continues to intensify, driven by industry pressures and technological advancements. Survey respondents identified compensation, hybrid work environments, and alignment of senior leadership team objectives as critical concerns.

Traditional mandates for returning to the office are no longer viable, underscoring the need for flexibility.

Demand for leaders with niche expertise in areas such as digital banking, fintech, and ESG (Environmental, Social, and Governance) continues to grow rapidly. These emerging skills are essential for navigating successive waves of transformation, including the rise of quantum AI and other advanced technologies.

Significant Challenges

We surveyed respondents on what they anticipated to be the most significant challenges facing their organizations.

Skills for the Future: What Leaders Need to Succeed

As the financial services sector continues to evolve, the skill sets required of leaders are expanding to meet the complexities of a changing environment.

Organizations face an urgent need to assemble and align clusters of specialized skills—including AI, cybersecurity, and advanced analytics—to broader business objectives.

According to our survey respondents, people leadership and team development remains the cornerstone of effective leadership. The ability to manage, engage, and develop talent is more critical than ever, particularly as organizations grapple with shifting workforce dynamics. Long-term strategic thinking, combined with the ability to foster innovation and build consensus, will be critical for navigating periods of uncertainty and ensuring organizational resilience.

Key Focuses for 2025 Leadership

To ensure C-Suite and Board leaders can effectively navigate the evolving financial services landscape, organizations are seeking leaders with key skills in various areas.

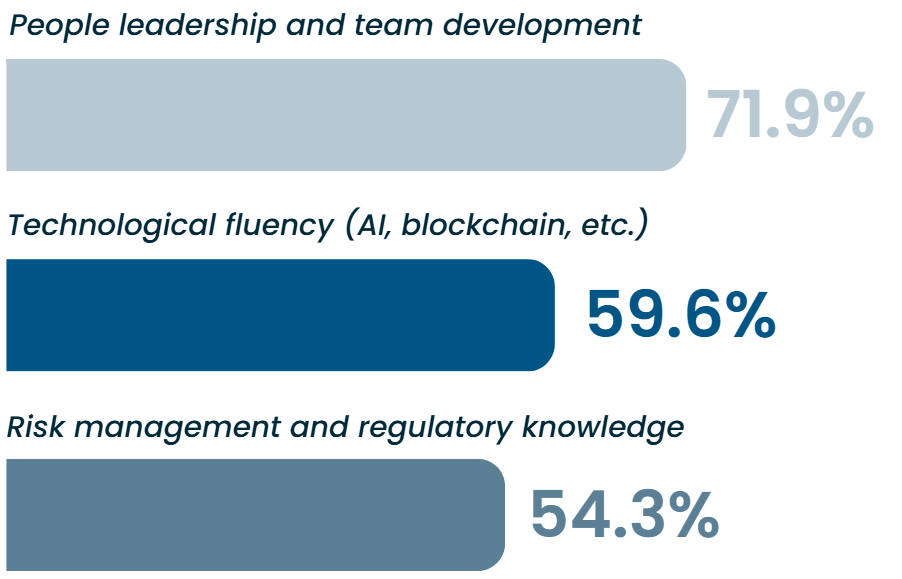

Of respondents surveyed, 71.9% identified people leadership and team development as essential skills for C-suite and board members, followed by technological fluency (59.6%) and risk management expertise (54.3%).

Defining the Path Forward: Key Leadership Focus Areas

AI-driven innovations and the emergence of advanced technologies such as quantum AI are poised to reshape the industry, enabling efficiencies and enhancing customer experiences. From personalized banking solutions to real-time risk monitoring, financial institutions are leveraging technology to gain a competitive edge.

However, the geopolitical landscape and evolving regulatory frameworks add layers of complexity. Trade tensions, supply chain disruptions, and shifting compliance standards can create significant operational uncertainty.

The evolving regulatory environment continues to demand attention, particularly in areas like cybersecurity and data privacy. With the increasing sophistication of cyber threats, executives are recognizing that cybersecurity must be fully integrated into the organizational culture, rather than serving as an isolated function.

To stay competitive, organizations must balance digital transformation with proactive approaches to geopolitical risks and regulatory compliance. Strong leadership will be crucial to fostering resilience and ensuring organizations can innovate while maintaining trust and stability.

Looking Ahead

The insights from our survey underscore the growing complexity of leadership in 2025, highlighting the need for adaptability, collaboration, and foresight.

Leaders must focus on assembling and aligning specialized skills—such as AI, cybersecurity, and quantum expertise—while adapting to evolving workplace dynamics like hybrid and remote work. Addressing these challenges will require a blend of internal development and external expertise to navigate talent acquisition, leadership assessment, and succession planning effectively. By prioritizing talent, fostering innovation, and strengthening governance frameworks, financial institutions can thrive in an era of uncertainty. Those who invest in building diverse, future-ready teams will not only navigate disruption but emerge as industry leaders in the years ahead.

About Massey Henry

Executive Search, Coaching, Assessment, and Advisory Services

Michael Henry

Managing Partner, Massey Henry

John Sanders

Senior Partner, Board & CEO Services

Lisa Newey

Partner

Alex Bunyan

Partner & Head, Leadership Practice